Planning for retirement can be a daunting task, but the right guidance can make it easier. Whether you’re just starting to think about retirement or you’re looking to fine-tune your plans, the right book can provide invaluable insights and strategies.

In 2024, several new and classic books stand out for their comprehensive and practical advice on retirement planning. Here are the ten best retirement planning books you should consider reading this year.

Why Retirement Planning is Crucial

Retirement planning is not just about saving money; it’s about ensuring a comfortable and secure future. With people living longer and costs of living rising, having a solid retirement plan is essential. The right resources can help you navigate complex financial landscapes and make informed decisions.

Best Retirement Planning Books

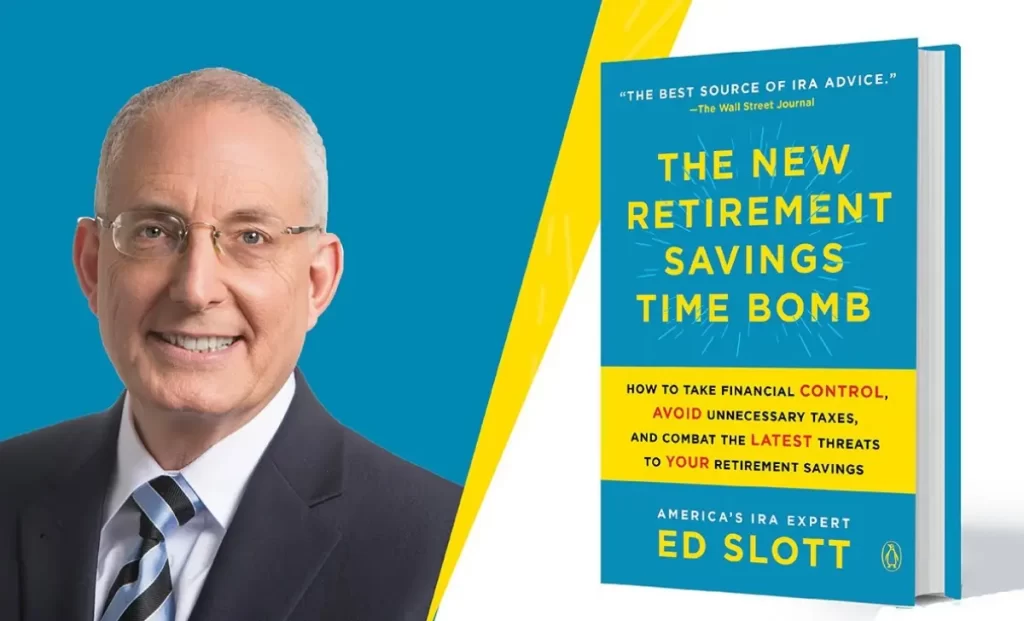

1. The New Retirement Savings Time Bomb by Ed Slott

Ed Slott’s “The New Retirement Savings Time Bomb“ is a must-read for understanding the complexities of tax-deferred retirement accounts. Slott, a nationally recognized IRA distribution expert, provides actionable strategies to avoid common pitfalls and maximize your retirement savings. The book covers critical topics like the best ways to manage your IRA, 401(k), and other retirement accounts to avoid hefty taxes and penalties.

Slott breaks down the often complicated rules and regulations surrounding retirement accounts into understandable advice. He explains the latest changes in tax laws and how they impact your retirement savings. The book also delves into the Secure Act, which significantly altered retirement planning rules, and offers practical advice on how to navigate these changes. Additionally, Slott emphasizes the importance of strategic planning to minimize taxes and maximize the growth of your retirement funds.

This book is suitable for anyone who wants to take control of their retirement savings and ensure they don’t fall into common traps that could jeopardize their financial security. Whether you are nearing retirement or have just started saving, Slott’s comprehensive guide can help you make the most of your retirement accounts.

2. Retire Inspired by Chris Hogan

Chris Hogan’s “Retire Inspired: It’s Not an Age, It’s a Financial Number” shifts the focus from the age of retirement to the financial readiness required to retire comfortably. Hogan, a financial coach and speaker, emphasizes that retirement is not an age but a financial number that you need to achieve to retire comfortably. His book is filled with practical advice and strategies to help readers set and achieve realistic retirement goals.

Hogan’s approach is highly motivational, aiming to empower readers to take control of their financial future. He provides detailed guidance on how to create a retirement plan tailored to your specific needs and circumstances. The book covers various aspects of retirement planning, including budgeting, saving, investing, and debt reduction. Hogan also addresses the psychological aspects of retirement, helping readers to envision their ideal retirement and stay motivated to achieve their goals.

This book is suitable for anyone looking to gain a clearer understanding of what it takes to retire successfully. Hogan’s practical advice and motivational style make it an excellent resource for those who feel overwhelmed by the prospect of planning for retirement.

3. How Much Money Do I Need to Retire? by Todd R. Tresidder

Todd Tresidder’s “How Much Money Do I Need to Retire?” simplifies the often confusing calculations involved in retirement planning. Tresidder, a former hedge fund manager and financial coach, offers a clear and straightforward method to determine how much you need to retire comfortably. His book provides a comprehensive guide to understanding the true costs of retirement and how to plan accordingly.

Tresidder debunks common myths and misconceptions about retirement planning, such as the idea that you need a million dollars to retire. Instead, he provides practical formulas and tools to help you calculate your specific retirement needs based on your lifestyle and financial goals. The book also covers topics like inflation, investment returns, and withdrawal rates, which are crucial for accurate retirement planning.

This book is particularly useful for those who are looking for a detailed and personalized approach to retirement planning. Tresidder’s expertise and clear explanations make complex financial concepts accessible, allowing readers to create a realistic and achievable retirement plan.

4. The Simple Path to Wealth by JL Collins

JL Collins’ “The Simple Path to Wealth” is perfect for those who want a no-nonsense approach to retirement planning. Collins, a seasoned investor and blogger, emphasizes the importance of low-cost index funds and provides a straightforward investment strategy that anyone can follow. His book is based on the principles he has shared with his daughter to ensure her financial independence.

Collins’ advice is simple yet powerful: focus on low-cost index funds, avoid debt, and invest consistently over time. He explains the benefits of index fund investing, including diversification, low fees, and the ability to capture the overall growth of the market. The book also covers essential topics like the power of compound interest, the importance of financial independence, and the steps to achieve it.

5. The Bogleheads’ Guide to Retirement Planning

This book is suitable for both beginners and experienced investors looking for a clear and effective investment strategy. Collins’ straightforward advice and engaging writing style make complex financial concepts easy to understand and implement.

“The Bogleheads’ Guide to Retirement Planning” is a comprehensive guide written by followers of John Bogle, the founder of Vanguard. This book covers everything from saving and investing to estate planning, making it an all-encompassing resource for retirement planning. The authors are seasoned investors and financial advisors who provide practical advice based on the principles of low-cost, passive investing.

The book is structured to guide readers through the various stages of retirement planning, starting with the basics of saving and investing. It covers essential topics like asset allocation, tax-efficient investing, and withdrawal strategies. The authors also provide detailed advice on healthcare, insurance, and estate planning, ensuring that readers have a complete understanding of all aspects of retirement planning.

This book is suitable for anyone looking for a comprehensive and detailed guide to retirement planning. The Bogleheads’ principles of simplicity and cost-efficiency make their advice particularly valuable for those seeking to build a solid retirement plan without getting bogged down in complex financial products and strategies.

6. Your Money or Your Life by Vicki Robin and Joe Dominguez

Vicki Robin and Joe Dominguez’s “Your Money or Your Life” offers a holistic approach to financial independence and retirement planning. The book focuses on transforming your relationship with money and achieving financial freedom well before traditional retirement age. Robin and Dominguez provide a nine-step program that helps readers reassess their priorities, reduce expenses, and increase savings.

The book emphasizes the importance of understanding the true value of your time and how it relates to money. It encourages readers to align their spending with their values and to live more intentionally. The authors provide practical tools and exercises to help readers track their spending, reduce debt, and build a sustainable financial plan.

This book is suitable for those looking to achieve financial independence and retire early. Robin and Dominguez’s holistic approach makes it an excellent resource for anyone seeking to improve their financial well-being and live a more meaningful life.

7. The Millionaire Next Door by Thomas J. Stanley and William D. Danko

Although not exclusively about retirement, Thomas J. Stanley and William D. Danko’s “The Millionaire Next Door” provides valuable insights into the habits and practices of those who have successfully accumulated wealth. The book is based on extensive research into the lives of millionaires and offers practical advice on how to build and maintain wealth.

Stanley and Danko debunk common myths about wealth and reveal that many millionaires live modestly, save diligently, and invest wisely. The book provides detailed profiles of typical millionaires and outlines the key behaviors and strategies that have led to their financial success. These include living below their means, avoiding debt, and focusing on long-term financial goals.

This book is suitable for anyone looking to understand the principles of wealth accumulation and apply them to their own financial planning. The insights provided by Stanley and Danko can help readers develop the habits and mindset needed to achieve financial independence and secure a comfortable retirement.

8. Smart Couples Finish Rich by David Bach

David Bach’s “Smart Couples Finish Rich” is tailored for couples looking to plan their retirement together. Bach, a renowned financial advisor, offers strategies for joint financial planning, ensuring both partners are aligned in their retirement goals. The book provides practical advice on how to create a shared vision for retirement, manage finances together, and build a solid financial foundation.

Bach emphasizes the importance of communication and collaboration between partners when it comes to financial planning. He provides detailed guidance on setting joint financial goals, creating a budget, and investing for the future. The book also covers important topics like debt reduction, insurance, and estate planning, ensuring that couples have a comprehensive plan in place.

This book is suitable for couples at any stage of their relationship who want to work together towards a secure and fulfilling retirement. Bach’s practical advice and emphasis on teamwork make it an invaluable resource for couples looking to achieve their financial goals together.

9. The 5 Years Before You Retire by Emily Guy Birken

Emily Guy Birken’s “The 5 Years Before You Retire” is essential for those nearing retirement. Birken provides a step-by-step guide for the crucial last five years before retirement, helping you to make the most of this critical period. The book covers a wide range of topics, including financial planning, healthcare, and lifestyle adjustments.

Birken emphasizes the importance of taking a proactive approach to retirement planning in the final years before retirement. She provides practical advice on how to maximize your retirement savings, reduce expenses, and plan for healthcare costs. The book also addresses

the emotional and psychological aspects of retirement, helping readers to prepare for the transition to a new phase of life.

This book is suitable for anyone approaching retirement who wants to ensure they are fully prepared for the transition. Birken’s comprehensive and practical advice makes it an excellent resource for those looking to make the most of their final working years.

10. Retirement Reinvention by Robin Ryan

Robin Ryan’s “Retirement Reinvention” addresses the non-financial aspects of retirement, such as finding purpose and staying active. Ryan, a career counselor and author, provides practical advice on how to create a fulfilling and enjoyable retirement. The book focuses on helping readers identify their passions and interests, and how to incorporate them into their retirement plans.

Ryan emphasizes the importance of staying mentally and physically active in retirement. She provides detailed guidance on how to find new hobbies, volunteer opportunities, and part-time work that align with your interests and skills. The book also covers important topics like maintaining social connections, staying healthy, and finding a sense of purpose in retirement.

This book is suitable for anyone looking to ensure their retirement years are fulfilling and enjoyable. Ryan’s practical advice and focus on the non-financial aspects of retirement make it an excellent resource for those looking to create a well-rounded and meaningful retirement plan.

What to Look for in a Retirement Planning Book

When choosing a retirement planning book, consider the following:

- Author’s Expertise: Look for books written by certified financial planners or experienced investors.

- Practical Advice: Opt for books that offer actionable steps and strategies.

- Comprehensive Coverage: The best books cover a range of topics, including saving, investing, taxes, and estate planning.

- Reader Reviews: Check reviews to see if other readers found the book helpful and informative.

How to Use These Books Effectively

- Set Clear Goals: Define your retirement goals before diving into any book.

- Take Notes: Highlight key points and jot down actionable steps.

- Discuss with a Financial Advisor: Use the insights gained to have informed discussions with your financial advisor.

- Review Regularly: Retirement planning is an ongoing process; regularly review and adjust your plan as needed.

FAQs

-

What is the best age to start retirement planning?

It’s never too early or too late to start retirement planning. The earlier you start, the more time you have to grow your savings.

-

How much money should I save for retirement?

This varies based on your lifestyle, retirement goals, and expected retirement age. Many experts recommend saving enough to replace 70-80% of your pre-retirement income.

-

Are there any retirement planning books for beginners?

Yes, books like The Simple Path to Wealth by JL Collins and Retire Inspired by Chris Hogan are great for beginners.

-

How often should I review my retirement plan?

It’s a good practice to review your retirement plan annually or whenever there are significant changes in your life or financial situation.

-

Can these books replace a financial advisor?

While these books provide valuable insights, they cannot replace personalized advice from a financial advisor.

-

Do I need to read multiple books on retirement planning?

Reading multiple books can provide a broader perspective and more comprehensive strategies for retirement planning.

Conclusion

Retirement planning is a critical aspect of financial health that requires careful consideration and informed decision-making. The ten books listed here offer a wealth of knowledge and practical advice to help you secure a comfortable and fulfilling retirement. Whether you’re just starting or looking to fine-tune your plans, these books are valuable resources that can guide you every step of the way.